All Categories

Featured

Table of Contents

Maintaining all of these acronyms and insurance kinds directly can be a migraine. The following table positions them side-by-side so you can promptly differentiate among them if you obtain puzzled. One more insurance policy coverage type that can repay your home loan if you die is a conventional life insurance policy plan

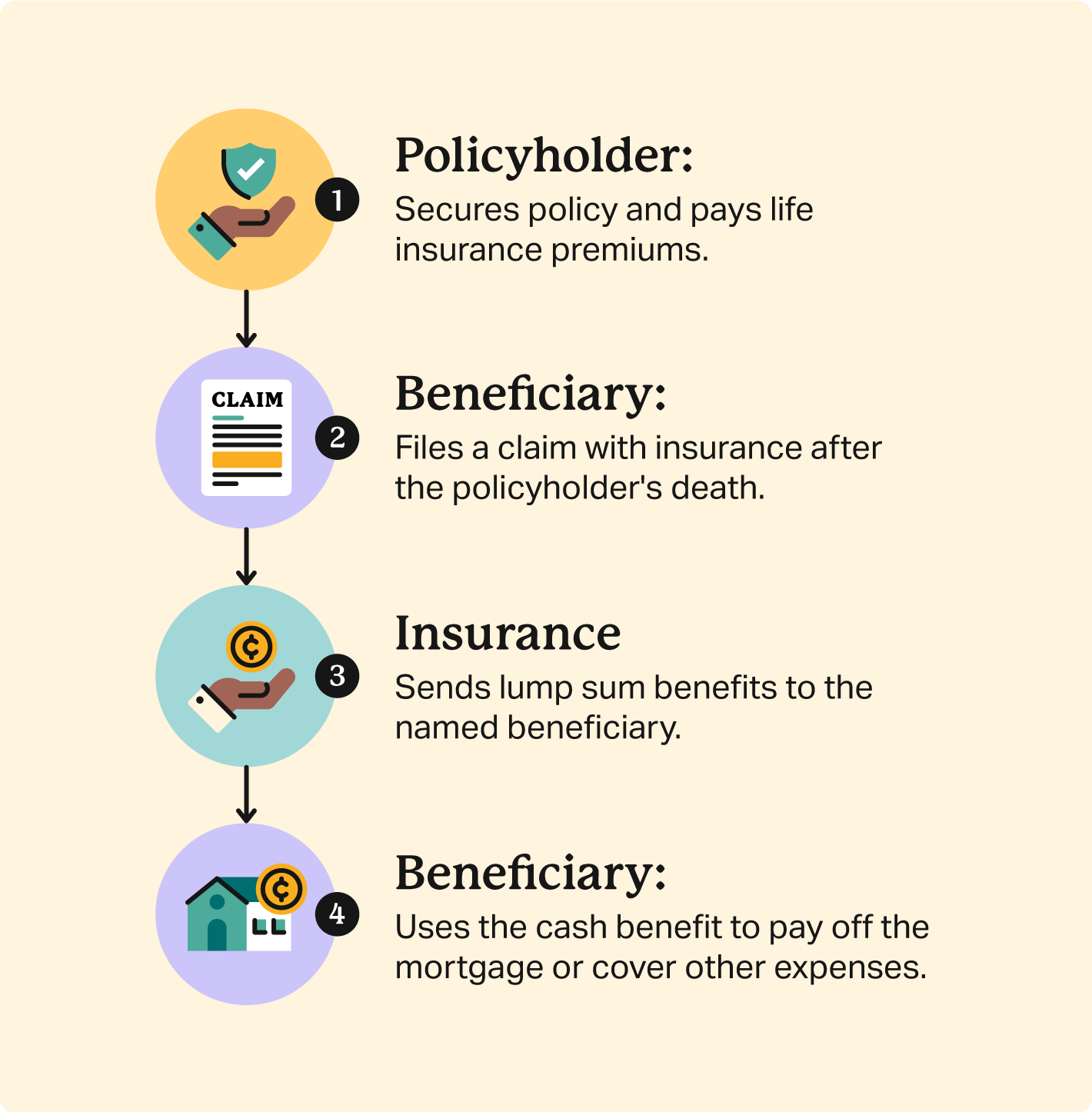

An is in location for an established number of years, such as 10, 20 or thirty years, and pays your beneficiaries if you were to die throughout that term. An offers insurance coverage for your whole life period and pays when you pass away. As opposed to paying your mortgage loan provider straight the means home loan protection insurance coverage does, conventional life insurance coverage plans most likely to the recipients you pick, who can after that choose to repay the home mortgage.

One common general rule is to intend for a life insurance policy plan that will pay out as much as ten times the insurance holder's wage quantity. Additionally, you could select to make use of something like the dollar approach, which adds a family members's financial obligation, revenue, home loan and education costs to calculate how much life insurance policy is required (life and critical illness insurance for mortgage).

It's also worth noting that there are age-related limitations and limits imposed by virtually all insurers, who often won't offer older purchasers as lots of options, will certainly charge them extra or might deny them outright.

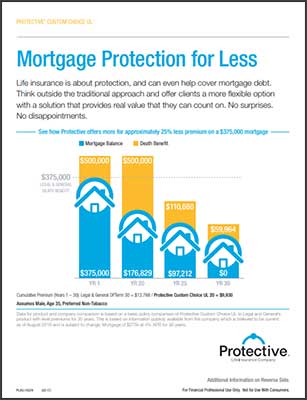

Below's how home mortgage security insurance coverage gauges up versus common life insurance policy. If you're able to certify for term life insurance, you ought to stay clear of mortgage defense insurance coverage (MPI).

In those situations, MPI can offer terrific comfort. Simply make certain to comparison-shop and review all of the small print before authorizing up for any plan. Every home loan protection option will have countless guidelines, policies, advantage options and drawbacks that need to be evaluated thoroughly versus your precise scenario (insurance and loan).

Mortgage Redemption Insurance Definition

A life insurance policy policy can aid pay off your home's home mortgage if you were to pass away. It's one of many manner ins which life insurance policy might help safeguard your enjoyed ones and their financial future. One of the ideal means to factor your mortgage right into your life insurance policy demand is to talk with your insurance policy agent.

Rather than a one-size-fits-all life insurance policy, American Domesticity Insurer uses policies that can be created especially to satisfy your family members's needs. Here are several of your alternatives: A term life insurance policy plan. payment protection insurance calculator is active for a details quantity of time and generally offers a bigger amount of insurance coverage at a reduced rate than a permanent plan

Instead than just covering a set number of years, it can cover you for your whole life. It also has living advantages, such as cash worth buildup. * American Household Life Insurance Company uses various life insurance policy plans.

They may also be able to help you locate spaces in your life insurance coverage or brand-new means to save on your other insurance coverage plans. A life insurance coverage beneficiary can pick to use the death benefit for anything.

Life insurance is one method of assisting your household in settling a home loan if you were to pass away before the mortgage is entirely repaid. No. Life insurance policy is not mandatory, yet it can be a vital part of aiding make sure your liked ones are monetarily safeguarded. Life insurance policy profits might be used to help settle a home loan, yet it is not the same as home loan insurance that you could be called for to have as a problem of a loan.

Home Protector Insurance

Life insurance might help guarantee your residence remains in your family by providing a death benefit that may assist pay down a home loan or make important acquisitions if you were to pass away. This is a quick summary of protection and is subject to policy and/or motorcyclist terms and problems, which might vary by state.

Words life time, long-lasting and permanent are subject to policy terms and problems. * Any type of fundings taken from your life insurance policy policy will build up rate of interest. home insurance after paying off mortgage. Any type of impressive loan balance (funding plus passion) will certainly be subtracted from the survivor benefit at the time of insurance claim or from the cash worth at the time of surrender

Discount rates do not use to the life plan. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage defense insurance coverage (MPI) is a different type of guard that can be handy if you're incapable to settle your home loan. Home mortgage defense insurance coverage is an insurance policy that pays off the rest of your mortgage if you pass away or if you become handicapped and can't function.

Like PMI, MIP protects the lending institution, not you. Nonetheless, unlike PMI, you'll pay MIP throughout of the finance term, in the majority of instances. Both PMI and MIP are called for insurance policy coverages. An MPI policy is completely optional. The quantity you'll spend for mortgage defense insurance policy depends upon a selection of variables, including the insurance provider and the current equilibrium of your home mortgage.

Still, there are advantages and disadvantages: A lot of MPI policies are provided on a "guaranteed approval" basis. That can be advantageous if you have a wellness problem and pay high rates permanently insurance or battle to obtain coverage. what does mortgage insurance do. An MPI policy can supply you and your household with a complacency

Mortgage Lender Insurance

You can pick whether you need home mortgage security insurance policy and for just how lengthy you require it. You may want your mortgage security insurance policy term to be close in length to exactly how long you have left to pay off your home loan You can terminate a home mortgage defense insurance plan.

Latest Posts

Instant Quote On Life Insurance

Funeral Expense Insurance

Insurance Funeral Expenses